A Network of Entrepreneurs

200 Zeichen Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quu.

Kim Notz

17. September 2024

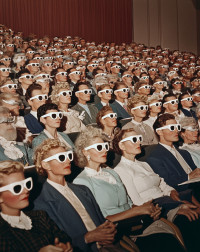

In recent years, new players have positioned themselves between owner-managed agencies and the big advertising holding companies. Alongside IT consultancies, financial investors have also entered the field. For the consultancies, the primary goal was to expand and round out their service portfolios. Venture capitalists and other financiers, however, see first and foremost a growth market. The digital agency sector is expanding rapidly—while remaining highly fragmented.

From an investor’s perspective, this market offers the chance for consolidation: bringing agencies with different capabilities under one roof, providing them with growth capital, and selling the combined structure at a profit after a few years. For agency owners, financial capital holds out the promise of faster growth, a broader context for their business—or even a full exit, for example in the case of succession planning.

Lorem ipsum dolor sit amet, adipiscing elit.

The rather dry word consolidation usually means the sale and acquisition of agencies that were previously independent and owner-managed. Former owners, if they stay on at all, become salaried managers. Agency brands disappear or are absorbed into larger groups. The focus shifts toward numbers and away from culture. Collaboration with sister agencies within the group becomes the norm—on both existing and new clients.

Each of these points represents a potential fault line that, sooner or later, often leads to the departure of the former owners. Senior leaders and other key talent frequently follow. For the buyers, this erosion is rarely welcome, since in our industry the people themselves account for a significant share of the value acquired. Clearly, different structures are needed to keep entrepreneurial minds on board.

One such model is the one the MYTY Group has been building for nearly five years. I spoke about it in episode #120 with founder and CEO David Rost. MYTY brings together different agencies under the umbrella of a holding group. The agency brands remain intact, while the founders and owners exchange their shares for a stake in the entire group. The necessary capital is provided by investor Ufenau Capital Partners.

A Question of Zeitgeist

David brought his own agency, Intergr8, into the group as its nucleus. Today, MYTY includes 14 agencies and 22 offices across Germany, Switzerland, and Croatia, with around 800 people. The core idea is to cultivate specialization within a group. Beyond a certain size, it becomes difficult for an individual agency to scale operational excellence across all areas. For David, specialization—more in demand than ever, in his view—is also very much a reflection of the zeitgeist.

Lorem ipsum dolor sit amet, adipiscing elit.

And even though the agency brands remain intact, individual teams often find a new home with the respective specialists. Back in 2020, Intergr8 was still more of a one-stop shop for digital strategy consulting, creation, tech, and marketing. Today, some of those areas have moved into other agencies within the MYTY Group.

A core conviction of the group is to preserve entrepreneurship within the network. Founders and driving forces within the agencies should not be turned into corporate managers—experience shows that rarely works for long. Nor do they believe in generalists; instead, they value real depth in the core disciplines. That also requires a high degree of cultural individuality and freedom. There are clearly positioned centers of expertise and credible brands with a right to exist—brands that both clients and employees can relate to.

Finally, through reinvestment in the group, a sense of ownership emerges, creating an ecosystem in which everyone participates in the common cause. This reduces conflicts of interest. There’s a shared stake in the success of the group as a whole. Former owners suddenly hold equity in all of the agencies equally—removing friction before it even has the chance to arise.

The Search for Perspective

The group provides a platform—or umbrella—for the individual agencies. Specialization, in turn, makes collaboration essential, since clients often need more than any single specialist agency can deliver. A shared P&L makes cooperation easier, but beyond that the MYTY Group leaves it to each agency to decide if, when, and how they want to collaborate.

Before founding the MYTY Group, David explored various options for accelerating growth and further development at Intergr8. In a consolidating market, an agency can either be on the buyer’s side or the seller’s side. Buyers need capital; sellers need an attractive outlook. For a transaction to happen, both elements have to align.

After many conversations with market players—including strategy and IT consultancies—David found that what was missing was a convincing integration model with real perspective. That led him to the idea of constructing a group model where all participants truly pull in the same direction. He then began looking for financial investors with the necessary capital.

Once that capital was secured and the group was founded, the Covid pandemic hit—creating the opportunity to hold management meetings with potential agency partners remotely. While it can’t replace personal contact, this approach proved much faster and more efficient. It also allowed David to get to know a large number of agencies and gain a strong overview of the industry landscape.

The Best of Both Worlds

Ultimately, it’s about skillfully combining the best of both worlds: the speed, agility, and thematic specialization of independent agency “speedboats” with their lean teams—together with the scale advantages of an agency group. It starts with shared services, for example in finance and HR, continues with investments in technology, and extends to new business development and joint work on larger clients.

In a growing market, independent agencies can also grow organically and remain successful over the long term. There is plenty of space for focused agencies in their respective specialties. But when the question of consolidation arises, the role one takes can be either active or passive—acquiring or being acquired. And if the journey ends in acquisition, then at the very latest, the question of perspective comes into play.

Lorem ipsum dolor sit amet, adipiscing elit.

For many entrepreneurs, the prospects within large agency networks or consulting giants turn out to be less than appealing. Two words sum it up: politics and bureaucracy. Too often, the focus shifts away from clients, projects, and results toward internal power struggles and paralyzing processes. That quickly outweighs the advantages of scale, market clout, breadth of capabilities, or stronger purchasing power on the procurement side.

Then there’s the cultural aspect. If specialists need their own biotopes—and clients prefer to work with specialists rather than generalists—then a group like MYTY has clear advantages. In traditional corporate structures, nurturing and protecting such specialist environments is far more difficult. For agency founders, meanwhile, it offers the chance to continue the journey—instead of exiting and perhaps starting all over again with a new venture.

Find more here:

Kontakt